Office investment as a percent of GDP peaked at 0.46% in Q1 2008 and then declined sharply. Investment as a percent of GDP fell to a new low in Q1 and is now down 64% from the peak.Click on the link above to see graphs that correspond with the above statistics.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 68% from the peak and at a new low in Q1 (note that investment includes remodels, so this will not fall to zero).

Lodging investment peaked at 0.32% of GDP in Q2 2008 and has fallen by about 82%.

Notice that investment for all three categories typically falls for a year or two after the end of a recession, and then usually recovers very slowly (flat as a percent of GDP for 2 or 3 years). This is happening again, and there will not be a recovery in these categories until the vacancy rates fall significantly.

Monday, April 30, 2012

Interesting Real Estate Stats

Here are some sobering statistics from the indispensable economics blog Calculated Risk.

Story To Watch - Part II - Chesapeake CEO

I have always believed that in the world of alternative investments, oil and gas sponsors tend to get away with internal deals that would not be allowed in other asset classes. The compensation perks of Chesapeake Energy's CEO, Aubrey McClendon, reinforce my opinion, even though Chesapeake does not sponsor retail oil and gas programs. McClendon received stakes in Chesapeake's wells and borrowed $1.1 billion against these interests. The conflicts of these arrangements are detailed in two articles here and here.

The second article describes how one of McClendon's creditors was a former Chesapeake board member. This paragraph sums up the relationship:

Update: This morning, Chesapeake stripped Aubrey McClendon of his Chairman of the Board duties. He will be replaced by and independent chairman but will remain CEO.

The second article describes how one of McClendon's creditors was a former Chesapeake board member. This paragraph sums up the relationship:

In June 1998, documents filed in Oklahoma County court show, McClendon had a financial relationship with Whittemore, a veteran Wall Street executive who served on Chesapeake's board from 1993 until 2011. For all eighteen years on Chesapeake's board and at the time of the loan, Whittemore served on Chesapeake's compensation committee. In that capacity, he helped determine how - and how much - McClendon would be paid. He also served as a member of the corporate governance and audit committees.Chesapeake's board is distancing itself from McClendon. Another one of McClendon's creditors is EIG Global Energy Partners, which also has provided financing to Chesapeake. Interesting. I still believe this story is worth watching.

Update: This morning, Chesapeake stripped Aubrey McClendon of his Chairman of the Board duties. He will be replaced by and independent chairman but will remain CEO.

Friday, April 27, 2012

Timberland Preemption

Maybe it's me, but this paragraph from a cover letter to Wells Timberland's annual investor update reads like it's preparing investors for some unpleasant valuation news:

There is encouraging news related to timber prices and housing. Here is a link (via Calculated Risk) to some optimistic news from home builders. Here is an except:

To me, it's hard to see how a 22% jump in new New Orders for homes and a 22% increase in order Backlog, along with an overall housing recovery, won't positively impact timber prices over time.

Below is a chart of timber prices since 2007:

It looks like timber prices are up a small amount so far in 2012, but sawtimber, the wood used in home building, is still well off its 2007 high.

Timberland's valuation will be subject to a variety of factors, many of which will be company-specific, and not directly related to the timber markets. To me, it looks as if the macro economic outlook for timber, via a housing recovery, is the best it's been in a long time.

In the year ahead, we'll have an opportunity to assess the market's impact on Wells Timberland REIT when we conduct an appraisal of the REIT’s assets in order to publish an estimated per-share value. We can't predict what the new estimated share value may be. However, we know that it will not necessarily represent the value you should expect to receive once the REIT goes “full cycle” and completes a future liquidity event, such as listing our shares on an exchange or selling our assets and distributing the proceeds to you, our stockholders. It will simply be a “snapshot” of the per-share estimated value at a certain time, which will help our management team make the most informed decisions on behalf of you and your fellow stockholders as we continue to move forward. The per-share estimated value will also be temporary, since we plan to estimate the per-share value again each year.It's smart of Wells to soft-pedal its upcoming valuation. I want to caution that I am not making any estimates as to Timberland's upcoming valuation, and based on the above, and it does not appear that Timberland has yet conducted its appraisal of its assets.

There is encouraging news related to timber prices and housing. Here is a link (via Calculated Risk) to some optimistic news from home builders. Here is an except:

Below is a summary of selected stats for the six publicly-traded builders who have released results for the quarter ended in March.(Note that 2010 figures are skewed upward due to the one-time, new home buyer tax credit that expired in April 2010.)

Settlements Net Orders Backlog 3/2012 3/2011 3/2010 3/2012 3/2011 3/2010 3/2012 3/2011 3/2010 D.R. Horton 4,240 3,516 4,260 5,899 4,943 6,438 6,189 5,281 6,314 NVR 1,924 1,634 1,919 3,157 2,403 2,940 4,909 3,685 4,552 PulteGroup 3,117 3,141 3,795 4,991 4,345 4,320 5,798 5,188 6,456 The Ryland Group 848 688 984 1,357 966 1,167 2,023 1,465 1,915 Meritage Homes 759 678 808 1,144 840 1,064 1,300 940 1,351 M/I Homes 507 439 475 764 654 765 933 747 936 Total 11,395 10,096 12,241 17,312 14,151 16,694 21,152 17,306 21,524 YOY % change 12.9% -17.5% 22.3% -15.2% 22.2% -19.6%

On Tuesday the Commerce Department estimated that new SF home sales last quarter were up 16% (not seasonally adjusted) from the comparable quarter of last year. Recently, of course, there has been a pattern of upward revisions to preliminary, and historically during improving markets such revisions are commonplace (and in declining markets, downward revisions are common). I’d bet that when the April new home sales report is released, March’s sales estimate will be revised higher.

To me, it's hard to see how a 22% jump in new New Orders for homes and a 22% increase in order Backlog, along with an overall housing recovery, won't positively impact timber prices over time.

Below is a chart of timber prices since 2007:

It looks like timber prices are up a small amount so far in 2012, but sawtimber, the wood used in home building, is still well off its 2007 high.

Timberland's valuation will be subject to a variety of factors, many of which will be company-specific, and not directly related to the timber markets. To me, it looks as if the macro economic outlook for timber, via a housing recovery, is the best it's been in a long time.

Thursday, April 26, 2012

Mega Auction

Last summer, I noted an Orange County mega-mansion that was listed for sale for $37 million and that had once been valued at $87 million. Well, there were no takers at $37 million, and today the estate was sold at auction. There is no word on the final price. Articles on the property are here, and here. The second link has a slide show of the gaudy monstrosity. (I am amazed at how someone can spend so much money building such an ugly home.) For those interested in the home, it still needs millions of dollars of work.

ARC Adds Management

American Realty Capital Healthcare Trust today announced that Thomas D'Arcy has joined the real estate investment trust as chief executive officer of the REIT's advisor. D'Arcy was formerly president and CEO for Grubb & Ellis Company. Adding an experienced outside executive is a positive development for ARC Healthcare Trust and American Realty Capital. I don't know the extent of D'Arcy's direct healthcare real estate knowledge, but his tenure at Grubb & Ellis, Inland and other real estate firms more than qualify him for his duties at ARC Healthcare. I wouldn't be surprised, given D'Arcy's background, to see his role within the growing American Realty Capital empire expand beyond ARC Healthcare, even if it's informally.

D'Arcy's Inland Real Estate Corporation (IRC) experience, curiously, was not included in the biography distributed by ARC Healthcare. He is still listed on IRC's website as the chairman of IRC's board of directors. I am not sure how much, if any, management responsibilities D'Arcy had (or has) at IRC, but IRC is a non-traded REIT success story. (D'Arcy joined IRC's board as an independent director in 2005.) I believe IRC offered its shares to investors at $10 per share in the mid- to late-1990s and early 2000s, but I couldn't quickly find the specifics of IRC's offering as I prepared this post. IRC listed its shares in mid-2004 at around $10.00 per share. Until the end of 2008, IRC traded well above $10 per share, and in early 2007, IRC briefly traded over $20 per share, allowing for about four years where original investors could have exited at a profit. Today, it closed at $8.56 per share and is yielding 6.66%. IRC's stock chart since its inception is below, courtesy of yahoo.finance.

D'Arcy's Inland Real Estate Corporation (IRC) experience, curiously, was not included in the biography distributed by ARC Healthcare. He is still listed on IRC's website as the chairman of IRC's board of directors. I am not sure how much, if any, management responsibilities D'Arcy had (or has) at IRC, but IRC is a non-traded REIT success story. (D'Arcy joined IRC's board as an independent director in 2005.) I believe IRC offered its shares to investors at $10 per share in the mid- to late-1990s and early 2000s, but I couldn't quickly find the specifics of IRC's offering as I prepared this post. IRC listed its shares in mid-2004 at around $10.00 per share. Until the end of 2008, IRC traded well above $10 per share, and in early 2007, IRC briefly traded over $20 per share, allowing for about four years where original investors could have exited at a profit. Today, it closed at $8.56 per share and is yielding 6.66%. IRC's stock chart since its inception is below, courtesy of yahoo.finance.

Tuesday, April 24, 2012

WSJ Article On Non-Traded REITs

It's late, but I just saw this Wall Street Journal article on non-traded REITs. The article is worth a post or two, but here is the passage that's going to grab attention:

The article talks about the differences between the non-traded REIT valuations. Sounds familiar... I am editing Part II of my valuation discussion.

Last year, the SEC and Finra began cracking down. The SEC has talked to about six nontraded REITs "on providing better disclosures on their share valuations," said Michael McTiernan, a lawyer in the SEC's division of corporate finance. He said the agency is pressing companies to give better disclosure on such things as how shares are valued and any conflicts with third-party advisers.

Mr. McTiernan declined to identify the REITs, but said that once news of the SEC's efforts spread, "disclosure throughout the industry quickly improved."The SEC has talked to six non-traded REITs on valuation disclosure. Let the speculation begin.

The article talks about the differences between the non-traded REIT valuations. Sounds familiar... I am editing Part II of my valuation discussion.

Salt On The Wound

Retail Properties of America (RPAI) investors are being hit with a mini-tender offer, where a third party investment fund is offering to purchase up to 200,000 shares of all four classes of RPAI stock for $6.50 per share. Remember, investors now own four classes of RPAI stock, the trading and liquid Class A shares, which closed today at $9.15 per share, and the three non-traded classes: B-1, B-2 and B-3. The three B classes will convert to Class A shares at six, twelve and eighteen months intervals from when RPAI first listed its stock. At the end of eighteen months, investors will own just the fully liquid Class A shares.

The mini-tender is offering to purchase the shares for a split-adjusted $6.50 per share, a sizable discount to today's closing price of $9.15. (Based on RPAI's original offer price, the tender offer is worth $2.60 per share.) The investment firm is providing liquidity, at a discounted price, for investors that don't want to wait up to eighteen months for full liquidity. I know non-traded REIT sponsors hate the investment funds that offer the mini-tender offers, but with RPAI's listed price, investors are better informed about their pricing options than if RPAI was estimating its net asset value. I'm not sure why an investor would tender the Class A shares when the shares are fully liquid, but stranger things have happened, and if you need the cash, the discount may not be so steep. RPAI could have stopped the mini-tenders by simply listing all its shares at once, so look for continued mini-tenders over the next eighteen months.

The mini-tender is offering to purchase the shares for a split-adjusted $6.50 per share, a sizable discount to today's closing price of $9.15. (Based on RPAI's original offer price, the tender offer is worth $2.60 per share.) The investment firm is providing liquidity, at a discounted price, for investors that don't want to wait up to eighteen months for full liquidity. I know non-traded REIT sponsors hate the investment funds that offer the mini-tender offers, but with RPAI's listed price, investors are better informed about their pricing options than if RPAI was estimating its net asset value. I'm not sure why an investor would tender the Class A shares when the shares are fully liquid, but stranger things have happened, and if you need the cash, the discount may not be so steep. RPAI could have stopped the mini-tenders by simply listing all its shares at once, so look for continued mini-tenders over the next eighteen months.

Cole's Mountain Of Money... And It's Anthill

Cole Credit Property Trust III (CCPT III) raised a staggering $600 million of equity in February and March as it closed its equity offering period. Based on an April 20th filing, Cole's subsequent offering to CCPT III, Cole Credit Property Trust IV (CCPT IV), has already raised more than $4.1 million, satisfied its escrow conditions of $2.5 million, declared a 6.25% distribution and acquired five properties. (It looks like two of the properties were purchased from affiliated entities, but before the alarm bells sound, I'd note that Cole routinely warehouses properties for its funds.)

Cole Corporate Income Trust is another story. It has been open since February 2011, and has only raised $20 million. I don't get the divergent sales figures between it and the CCPT funds. Corporate Income Trust is not that different from CCPT III and CCPT IV to account for such an anemic equity raise. Oh well, I have much more important things to keep me worried than trying to figure out why the rich isn't getting richer.

Cole Corporate Income Trust is another story. It has been open since February 2011, and has only raised $20 million. I don't get the divergent sales figures between it and the CCPT funds. Corporate Income Trust is not that different from CCPT III and CCPT IV to account for such an anemic equity raise. Oh well, I have much more important things to keep me worried than trying to figure out why the rich isn't getting richer.

Distressed Debt Sale

Here is a Bloomberg article on a large distressed debt sale. CWCapital, the second largest special servicer, is marketing a portfolio of bad mortgages on 76 properties. Special servicers are the firms that deal with troubled mortgages in commercial mortgage backed securities (CMBS). The article says that the portfolio is $345 million, which I am guessing is the face value of the mortgages, not the portfolio's estimated sale price. The actual sale price will likely be lower. I suspect the buyer will immediately start splitting and selling off the various mortgages, as the portfolio is a mixed bag with retail and office mortgages making up the largest portions of the pool. The $345 million may seem like a large number, but CWCapital has $21 billion of delinquent mortgages on its books, and it's only the second largest special servicer. LNR Property, the largest special servicer, is sitting on $23 billion of bad mortgages, according to the article.

The sale is a positive development. The new debt buyers may be more willing to negotiate with property owners on some mortgages, something special servicers avoided due to their obligation to bondholders. Other properties will be foreclosed and recapitalized, which is unfortunate, but necessary. Due to this quote below, I wouldn't expect deep discounts on the pool:

“Funds have raised a significant amount of capital to buy a tsunami of distressed debt,” according to Harris Trifon, a commercial-mortgage debt analyst at Deutsche Bank AG. “That tsunami never came. There is a lot of pent-up demand for that part of the market.”

The sale is a positive development. The new debt buyers may be more willing to negotiate with property owners on some mortgages, something special servicers avoided due to their obligation to bondholders. Other properties will be foreclosed and recapitalized, which is unfortunate, but necessary. Due to this quote below, I wouldn't expect deep discounts on the pool:

“Funds have raised a significant amount of capital to buy a tsunami of distressed debt,” according to Harris Trifon, a commercial-mortgage debt analyst at Deutsche Bank AG. “That tsunami never came. There is a lot of pent-up demand for that part of the market.”

Sunday, April 22, 2012

Building A Real Estate Brokerage Business

Here is a good (free) Wall Street Journal article on the integration of commercial real estate brokerage firms Newmark Knight Frank and Grubb & Ellis, at least what's left of it, into BGC Partners, Inc. BGC is a Cantor Fitzgerald spin-off, and both BGC and Cantor have the same chairman and CEO, Howard Lutnick. You don't hear as much about Lutnick as you do other Wall Street leaders, but I would not bet against him.

Friday, April 20, 2012

Friday Reading - Glitz and Grit

Here are two interesting articles. The first is a Wall Street Journal story on MGM's huge City Center development along the Las Vegas Strip. This project was started six years ago, so it couldn't have had worse timing. The article provides insight into the Las Vegas housing market:

Las Vegas has experienced some of the worst of the housing bust, exacerbated by overbuilding. Home prices in January in the Las Vegas area were down more than 60% since spring 2006, according to the S&P/Case-Shiller Home Price Index, including a 9% drop during 2011. Luxury high-rise condo towers that were constructed on or around the Las Vegas Strip at the height of the development frenzy were particularly affected.The second article switches from the glitz of Las Vegas to the grit of oil and gas drilling in shale rock formations. Bloomberg reports on earth quakes caused by fracking the shale for natural gas, in particular the impact of disposal wells used for fracking waste. This is quite a statistic:

But some hard-hit markets in the U.S. have begun to show signs of recovery. The high-rise condo market in Miami, for instance, has been buoyed by surprisingly strong demand from foreign buyers, and the Phoenix housing market has recently seen a large jump in demand from investors.

While the Las Vegas economy isn't as diverse as better-performing cities, there are some glimmers of improvement. Housing inventory levels are less than half a year ago, according to Applied Analysis, an economic consulting firm in Las Vegas. And gambling revenue on the Las Vegas Strip is up for the past six months through February, while visitation and room rates also have continued to edge up, according to the Las Vegas Visitors and Convention Authority.

U.S. Geological Survey researchers found that, for three decades prior to 2000, seismic events in the nation’s midsection averaged 21 a year. They jumped to 50 in 2009, 87 in 2010 and 134 in 2011, according to the study, which was presented April 18 at the annual meeting of the Seismological Society of America.According to the article, "researchers think an increase in wastewater injected into the ground by drilling operators may be the cause of a sixfold increase in the number of earthquakes that have shaken the central part of the U.S. from 2000 to 2011, according to a U.S. Geological Survey study."

Paging the Editor

Try and decipher this Bloomberg article. The article's title says that the Fairmont hotel, located on Nob Hill in San Francisco, is being sold for $200 million, but the sale is not mentioned in the article. The article instead discusses a complex financing plan for the company that owns the Fairmont hotel, Fairmont Hotels & Resorts, Inc. This sentence made me smile:

The resort chain, used as settings for Alfred Hitchcock films including North by Northwest and Vertigo, has included a so-called ratings grid that would be used to price the $500 million loan when it obtains ratings, said the person, who didn’t want to be identified because the plans aren’t public.How can a corporation be used used as a movie set? For someone who agonizes over my own small writing mistakes, the article made me realize I'm not the only one who occasionally makes an error.

Thursday, April 19, 2012

The Valuation's Too Damn High - Part I

I have been shaking my head at recent valuation figures for non-traded real estate investment trusts (REITs). Whether it's last month's release of KBS REIT I's predictable per share value of $5.16, or Strategic Storage's recent, near jaw-dropping valuation of $10.79 per share, the non-traded REIT valuation process is inconsistent and disparate. I am going to give my opinions and ideas on valuations over four posts. In this first post I will focus on the difference between a non-traded REIT's net asset value and its market value, with an emphasis on Retail Properties of America (RPAI). In the second post I will discuss various valuation methods used by non-traded REITs, the conflicts associated them, and what I feel are the responsibilities of the non-traded REITs' independent board members. I will give my opinion on the recent trend of REITs, in the midst of long offering periods, revaluing their share prices upward, and the marketing frenzy behind this repricing. Finally, I will give my thoughts on what should be done with non-traded REIT valuations.

RPAI's recent initial public offering and listing brought into harsh relief one problem with non-traded REITs estimating per share valuations - these valuation approximations may vary significantly from the REITs' stock market values. In June 2011, RPAI (then known as Inland Western REIT) presented shareholders with an estimated per share value of $6.95. Investors were rightly shocked when in early April 2012, a short eight months later, RPAI had its IPO and listing at a price equivalent of $3.20 per share. RPAI has settled in around a split-adjusted equivalent price of $3.60 per share (which is $9.00 per share on NASDAQ due to RPAI's reverse stock split), and while better than its IPO price, the current price is no salve to investors. The stock market is valuing RPAI around half of what RPAI management estimated its share value less than one year ago, and this with the backdrop of a retail real estate market that is gaining strength.

It's important to understand the distinction between what REIT management estimates a REIT's shares are worth and the price at which the public markets value a REIT's shares. Obviously, in the case of RPAI there was a big difference. Listed stocks, whether REITs or high flying tech companies, rarely trade at prices that equal to their net asset value. Stocks trade above or below their estimated net worth all the time. The whole Benjamin Graham school of value investing is based on the notion of investing in stocks that can be purchased for less than companies' intrinsic values. Generally, stocks, REITs included, trade based on the outlook for expected future earnings, not necessarily the value of the underlying assets.

After a REIT completes its offering period, its sponsor must provide shareholders periodic estimates of the REIT's value. I will discuss this in more detail in my next post, but non-traded REIT sponsors use multiple factors to determine a REIT's share price, including net asset value estimates and comparisons to other public REITs. REIT management compiles the data and presents the estimate to the REIT's board for approval. In a June 20, 2011, 8-K filing, RPAI's management provided an estimated per share value of RPAI's shares and disclosed in generalities the methods it used in determining the $6.95 per share value:

The first paragraph is the key to RPAI's valuation. RPAI was valued by its management without the use of third party appraisers, or even a third party valuation service, to confirm RPAI's management's assumptions and methodologies. RPAI's management used the direct capitalization method and "methodologies consistent with publicly traded real estate investment trusts." No detail is provided on what cap rates were used, or what comparable public company valuation metrics were employed - i.e. FFO multiples. I'd be curious to know what assumptions RPAI's management made regarding all RPAI's debt, especially the debt maturing over the next several years. The valuation is only as good as the inputs and assumptions, and while the methods may have been sound, the inputs dictate the output.

You don't think I was going to pass up a chance to include this picture given the title of this post!

RPAI's recent initial public offering and listing brought into harsh relief one problem with non-traded REITs estimating per share valuations - these valuation approximations may vary significantly from the REITs' stock market values. In June 2011, RPAI (then known as Inland Western REIT) presented shareholders with an estimated per share value of $6.95. Investors were rightly shocked when in early April 2012, a short eight months later, RPAI had its IPO and listing at a price equivalent of $3.20 per share. RPAI has settled in around a split-adjusted equivalent price of $3.60 per share (which is $9.00 per share on NASDAQ due to RPAI's reverse stock split), and while better than its IPO price, the current price is no salve to investors. The stock market is valuing RPAI around half of what RPAI management estimated its share value less than one year ago, and this with the backdrop of a retail real estate market that is gaining strength.

It's important to understand the distinction between what REIT management estimates a REIT's shares are worth and the price at which the public markets value a REIT's shares. Obviously, in the case of RPAI there was a big difference. Listed stocks, whether REITs or high flying tech companies, rarely trade at prices that equal to their net asset value. Stocks trade above or below their estimated net worth all the time. The whole Benjamin Graham school of value investing is based on the notion of investing in stocks that can be purchased for less than companies' intrinsic values. Generally, stocks, REITs included, trade based on the outlook for expected future earnings, not necessarily the value of the underlying assets.

After a REIT completes its offering period, its sponsor must provide shareholders periodic estimates of the REIT's value. I will discuss this in more detail in my next post, but non-traded REIT sponsors use multiple factors to determine a REIT's share price, including net asset value estimates and comparisons to other public REITs. REIT management compiles the data and presents the estimate to the REIT's board for approval. In a June 20, 2011, 8-K filing, RPAI's management provided an estimated per share value of RPAI's shares and disclosed in generalities the methods it used in determining the $6.95 per share value:

On June 14, 2011, the board of directors (the “Board”) of Inland Western Retail Real Estate Trust, Inc. (the “Company”) established an estimated per-share value of the Company’s common stock of $6.95. This estimated per-share value is being provided solely to assist broker dealers in connection with their obligations under applicable Financial Industry Regulatory Authority (“FINRA”) rules with respect to customer account statements and to assist fiduciaries in discharging their obligations under ERISA reporting requirements. The estimated value was determined by the use of a combination of different indicators and an internal assessment of value utilizing internal financial information under a common means of valuation under the direct capitalization method. No independent appraisals were obtained. Specifically, the estimate of the estimated per-share value was made with primary consideration of the valuation of the Company’s real estate assets which was determined by the Company’s management using methodologies consistent with publicly traded real estate investment trusts in establishing net asset values, and the estimated values of other assets and liabilities determined by the Company’s management as of March 31, 2011.The estimated per-share value is only an estimate and may not reflect the actual value of our shares or the price that a third party may be willing to pay to acquire our shares. The Board, in part, relied upon third party sources in arriving at this estimated value, which reflects, among other things, the continuing impact of adverse trends in the economy, the real estate industry and the current public equity markets. Because this is only an estimate, we may subsequently revise any estimated valuation that is provided. We cannot provide assurance that:

- this estimate of value reflects the price or prices at which our common stock would or could trade if it were listed on a national stock exchange or included for quotation on a national market system; or

- this estimate of value could actually be realized by us or by our shareholders upon liquidation; or

- shareholders could realize this estimate of value if they were to attempt to sell their shares of common stock now or in the future; or

- the methodology utilized to estimate the per-share value, would be found by any regulatory authority to comply with requirements of such regulatory authority, including requirements under ERISA, FINRA rules, other regulatory requirements or applicable law.

Further, the estimated per-share value was calculated as of a moment in time, and, although the value of the Company’s shares will fluctuate over time as a result of, among other things, developments related to individual assets and changes in the real estate and capital markets, the Company does not undertake to update the estimated value per share on a regular basis.

The first paragraph is the key to RPAI's valuation. RPAI was valued by its management without the use of third party appraisers, or even a third party valuation service, to confirm RPAI's management's assumptions and methodologies. RPAI's management used the direct capitalization method and "methodologies consistent with publicly traded real estate investment trusts." No detail is provided on what cap rates were used, or what comparable public company valuation metrics were employed - i.e. FFO multiples. I'd be curious to know what assumptions RPAI's management made regarding all RPAI's debt, especially the debt maturing over the next several years. The valuation is only as good as the inputs and assumptions, and while the methods may have been sound, the inputs dictate the output.

RPAI's management may have convinced itself and the board that RPAI's net asset value was $6.95 per share, but RPAI's stock is currently valued around $3.60 per share share. The $6.95 price per share may be technically correct based on RPAI's valuation assumptions, but the real, tangible value for investors is, unfortunately, $3.60 per share. Going forward, the net asset value of RPAI, or any listed stock, is irrelevant to the price an investor can buy or sell shares.

Non-traded REIT managers and the boards of directors better be realistic when providing

valuation estimates, because investors rely on these for an accurate approximation of the value of their investment.

If a non-traded REIT expects to list the REIT’s shares on a stock

exchange as the planned exit strategy, its management better go the extra step to hone its

valuation estimate. I know it's impossible to accurately guess the price at which the market will value a non-traded REIT. No one is expecting valuation estimates to exactly match listing prices, but it's not hyperbole to say that a 50% disconnect is unacceptable. As shown by RPAI, it serves no purpose for a REIT to self-value at a price that has no relationship to what a REIT’s stock

could trade for when listed. Non-traded REIT independent directors need to do their job and demand pricing candor, even if it bruises REIT management egos.

No Where To Hide

Here is a post from the Financial Times' Alphaville blog. It shows the asset class correlations pre- and post-Lehman collapse. The post attributes increased correlations to "risk on, risk off" trades, but it sounds like fancy justificaton for lemming money managers.

Wednesday, April 18, 2012

Story To Watch - Chesapeake CEO

I bet we've not heard the last about this story on Chesapeake's CEO's $1.1 billion of personal loans.

Digging Deeper

Here is short article worth reading from the Wall Street Journal. The article discusses a $49 million loan that JP Morgan pulled from a $1 billion commercial mortgage backed security (CMBS) it was set to issue. The loan was a refinance of two shopping centers in Boca Raton, Florida, with a total of 183,000 square feet. The properties' combined occupancy was 97% and they were appraised at $72 million in January. The $49 million loan was replacing a $44.2 million loan that was in default. The following passage is why I think the loan was removed:

Glades Plaza and The Commons at Town Center, actually two properties on different sides of NW 19th Street in Boca Raton, were developed in 1979 and appraised at $72 million in January, according to a description of the property in the initial J.P. Morgan loan documents. Its occupancy has increased to 97% from 54% in 2009 and its tenants include Hooters, a Brewzzi microbrewery and Barbara Katz Sportswear, the description states.

The properties are over thirty years old, and despite the combined 183,000 square feet, it does not look like there was a major anchor tenant. The properties' owner, which is a developer not a retailer, leasing over 6% of the space and being the largest tenant was probably not viewed as a positive.

The complex's largest tenant, with about 11,400 square is its landlord, Woolbright, according to the company's website and loan documents.

Monday, April 16, 2012

Good Golden State Housing News

Here is an article from Bloomberg on housing price increases in California. Prices were up 1.6% from a year ago, the first year-over-year increase in sixteen months. The sales were up 9.2% from the previous month, the largest monthly increase since 2004. While a 9% month-to-month increase was likely an anomaly, the metrics are positive, with supply down to 4.1 months (7 months is normal) and days-to-sale dropping to 53 days from 57 days.

Best Buy Closure List

Here is the Best Buy closure list via The CRE Review. I need to cross-reference it against some of the non-traded REITs, in particular the Inland REITs, including Retail Properties of America, and Cole REITs, which own retail real estate. It's important to remember that closing a store doesn't mean that Best Buy is going to stop paying rent. It's still obligated by its leases to keep making lease payments.

Update: On a quick overview I didn't see any of Retail Properties of America's Best Buys on the closure list.

Update Update: Did not see any Best Buy closures in Inland American's portfolio, but its website is clunky (have to search by property for each state), so I didn't check all states. I only saw one closure in the Cole portfolios, a Best Buy in Fort Meyers, FL, which is owned by Cole Credit Property Trust III.

(On a separate matter, I don't think I want to know about the 191 Church's Chicken, 42 Applebee's and 26 On The Border restaurants spread across multiple Cole REITs.)

Update: On a quick overview I didn't see any of Retail Properties of America's Best Buys on the closure list.

Update Update: Did not see any Best Buy closures in Inland American's portfolio, but its website is clunky (have to search by property for each state), so I didn't check all states. I only saw one closure in the Cole portfolios, a Best Buy in Fort Meyers, FL, which is owned by Cole Credit Property Trust III.

(On a separate matter, I don't think I want to know about the 191 Church's Chicken, 42 Applebee's and 26 On The Border restaurants spread across multiple Cole REITs.)

Sunday, April 15, 2012

Vornado's Outlook

From Bloomberg, here is a commercial real estate outlook from Vornado Realty Trust's Steven Roth. He has an optimistic tone here:

“We are in a recovery (but by no means recovered),” he wrote in the letter. “Consensus is that the recovery will be shallow and as such, I believe it will be much longer in duration than the three to five to seven year economic cycles that we are used to. All this will prove to be a very good environment for our business.”He goes on to say:

“I must say, I find investing in this market difficult,” he wrote. “Nobody expected building prices to bounce back as strongly or as quickly as they did -- but they did. Assets are not cheap, either historically or in relation to current rents.”The article is short and worth reading.

Friday, April 13, 2012

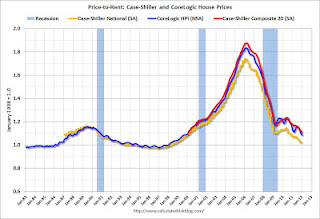

Price-To-Rent

Below is a great graph from Calculated Risk, which provides visual evidence that the housing market is going to rebound. The graph shows the price-to-rent ratio between the cost to own a home versus renting. The higher the higher the ratio, the more expensive it is to own a home. Looking at this graph, the housing bubble is easy to see. The ratio is approaching levels last seen in the late 1990s, indicating that home ownership is nearly as cheap as renting.

The graph also ties in with my previous post on AIG. If AIG is looking for large multifamily development investments, it's probably a sign that large multifamily projects are near a top.

The graph also ties in with my previous post on AIG. If AIG is looking for large multifamily development investments, it's probably a sign that large multifamily projects are near a top.

Wednesday, April 11, 2012

Back In The Game

Here is a Wall Street Journal article by way of Yahoo Finance on AIG's reentry into the commercial real estate market. AIG, according to the article, is going to focus on apartment developments in major metropolitan markets.

Tuesday, April 10, 2012

Your Mother Was A Hamster and Your Father Smelled Of Elderberries

The following is a letter sent yesterday (and filed in an 8-K) by American Realty Capital Healthcare Trust to the board of directors of Griffin-American Healthcare REIT II:

This letter is an instant classic, a candidate for the "Wow" Hall of Fame.American Realty Capital Healthcare Trust, Inc. (“ARC Healthcare”) no longer sees the acquisition of the former Grubb & Ellis Healthcare REIT II, Inc. (“GEHRII”), now Griffin-American Healthcare REIT II, Inc. (“GAHRII”), to be viable due to the substantial risk of litigation between GAHRII and Grubb & Ellis, and the potential sizeable liability and cost to defend such action. Therefore, effective immediately, we are withdrawing our offer to acquire GAHRII.There exists an allegation in a pending bankruptcy petition1 that GAHRII has failed to pay millions of dollars currently due and owing to Grubb & Ellis. Furthermore, Grubb & Ellis maintains that they have material and substantial claims against GAHRII. Moreover, some of these monies, Grubb & Ellis alleges, are owed to Grubb & Ellis and have been paid instead to American Healthcare Investors, an entity owned and operated by Mr. Hanson and other former executive officers of Grubb & Ellis.Because, in our view, there is risk of potential litigation between GAHRII and Grubb & Ellis which could result in an unquantifiable liability to ARC Healthcare’s stockholders, we believe it would be imprudent for our board of directors to expose ARC Healthcare to a risk that cannot be insured against or limited in amount.For these reasons, we no longer see the acquisition of GAHRII to be viable from a financial or portfolio standpoint, and therefore effective immediately we are withdrawing our offer to acquire GAHRII.

The letter can be read another way. American Realty Capital Healthcare Trust, on the heels of American Realty Capital Trust's successful NASDAQ listing, is raising substantial amounts of equity every month and gaining scale fast. It doesn't need the headache and potentially Pyrrhic outcome that a stockholder fight to gain control of Griffin-American Healthcare REIT II would entail.

American Realty Capital Healthcare Trust couldn't resist a competitive taunt on withdrawing its offer for Griffin-American Healthcare REIT II. It reminded me of this classic scene from Monty Python and the Holy Grail:

Natural Gas Approaches Mendoza Line

The price of natural gas is approaching the $2.00 per MMBtu Mendoza Line. The price for the Nymex Henry Hub Future is $2.07 MMBtu.

Sunday, April 08, 2012

Real Estate Round Up

I saw the three articles linked to below earlier in the week on Calculated Risk. The posts discuss Reis' quarterly updates on the commercial real estate segments of apartments, office buildings and strip malls.

Apartments

Office

Strip Malls

Apartments continue to improve, with vacancy rates falling to 4.9% and rents up nearly 1% in the first quarter. The national office market saw a fractional drop in vacancy and a .5% increase in asking rents. Strip malls saw vacancies drop for the first time in seven years.

Apartments

Office

Strip Malls

Apartments continue to improve, with vacancy rates falling to 4.9% and rents up nearly 1% in the first quarter. The national office market saw a fractional drop in vacancy and a .5% increase in asking rents. Strip malls saw vacancies drop for the first time in seven years.

Thursday, April 05, 2012

Retail Properties - Use of Proceeds

Retail Properties of America just filed its final prospectus related to its IPO and listing. It raised $254.4 million, and expects to net $231 million after underwriting discounts and expenses. From the net proceeds, $82 million will pay down RPAI's senior unsecured line of credit, which will be paid to affiliates of the underwriters. RPAI will use $95 million to repay a cross-collateralized pool of mortgages. The final $55 million will go to repurchase an affiliate's interest in a joint venture between RPAI and the affiliate.

Retail Properities of America Prices

Retail Properties of America's (RPAI) IPO was priced last night at $8.00 per share. This was below the anticipated price range of $10 per share to $12 per share. The $8.00 price is equivalent to $3.20 per share for original investors due to the 2.5 to 1 reverse stock split RPAI recently executed. Based on the $8 share price, RPAI raised $254.4 million in the IPO, which was below the estimated $350 million specified in RPAI's S-11 filing last week. I am not sure if the use of proceeds changed based on this lower equity raise, but originally, lending affiliates of the underwriters were scheduled to receive $170 million from IPO proceeds to repay RPAI debt.

The $8.00 IPO price does not mean the stock will trade at this price. It looks like early trades are about 9% to 10% above the IPO price, which is positive.

The $8.00 IPO price does not mean the stock will trade at this price. It looks like early trades are about 9% to 10% above the IPO price, which is positive.

Tuesday, April 03, 2012

Retail Property of America's Listing Set

I saw this on Seeking Alpha. Retail Properties of America (RPA) is set to be priced tomorrow night, Wednesday, April 4, 2012, and to begin trading on Thursday, April 5th. Based on last week's S-11, the target price is $10 - $12 (remember the 2.5:1 reverse stock split).

Inland is distancing itself further from RPA by changing its stock symbol. RPA will trade under the symbol RPAI.

Inland is distancing itself further from RPA by changing its stock symbol. RPA will trade under the symbol RPAI.

More Foreclosure to Rental

Here is another article on large scale foreclosure purchases with the intent to rent, this time from the New York Times. Waypoint Real Estate Group, which I wrote about last month, was profiled again, and the article says much of the same. I still think the exit strategy will frustrate the private equity / hedge fund investors. One point not discussed in the article is home affordability. Several years ago, even after home prices started collapsing, you couldn't buy homes in Southern California as competitive rental properties. The yield was too low, I'd guess in the 2% to 4% range. Waypoint is earning 8%, after improvements on its acquisitions:

Waypoint's growth projections are amazing. It started buying homes in 2008 and now owns 1,200 homes, but it expects to have 10,000 to 15,000 homes by the end of next year. An important part of these rental transactions is the "turn" - making the improvements and getting the property rented after acquisition. Time and low costs are crucial, as cost overruns and delayed rentals at the outset impact the long-term total return of a property. Good property management is vital, and Waypoint is going to have up to 15,0000 different locations that need overseeing. The properties need to stay leased and maintained over the hold period so that the properites can benefit from rising real estate prices. It's easy to spot the opportunity with foreclosed homes, but the profit potential is not so great that sloppy upfront execution and bad property management won't spoil the investment.

An algorithm calculates a maximum bid for each home, taking into account the cost of renovations, the potential rent and target investment returns — right now the company averages about 8 percent per property on rental income alone.While this is good for Waypoint investors, it's better news for other potential home buyers and current home owners, because it addresses home affordability. Yields this high on home rentals indicate that home prices are more affordable, because price and yield are inversely related - low yield equals high prices and high yield equals low prices.

Waypoint's growth projections are amazing. It started buying homes in 2008 and now owns 1,200 homes, but it expects to have 10,000 to 15,000 homes by the end of next year. An important part of these rental transactions is the "turn" - making the improvements and getting the property rented after acquisition. Time and low costs are crucial, as cost overruns and delayed rentals at the outset impact the long-term total return of a property. Good property management is vital, and Waypoint is going to have up to 15,0000 different locations that need overseeing. The properties need to stay leased and maintained over the hold period so that the properites can benefit from rising real estate prices. It's easy to spot the opportunity with foreclosed homes, but the profit potential is not so great that sloppy upfront execution and bad property management won't spoil the investment.

Sunday, April 01, 2012

Circumstance

The audio clip below was secretly recorded at the board meetings of KBS REIT I, Inland Western and the Behringer Harvard REITs, and passed on to me under strict conditions of anonymity:

It's amazing that the comment was identical at all the REITs.

It's amazing that the comment was identical at all the REITs.

Inland American's Hotel Expansion

Here is a free Wall Street Journal article on Inland American REIT's recent acquisition of five upscale hotels in three transactions. Inland American is expanding out of limited service hotels into higher-end hotels. Before the three acquisitions, Inland American owned 98 limited service and extended stay hotels. It will pay $393.1 million for the five hotels.

Here is chart from Calculated Risk showing a steady improvement in hotel occupancy:

The Calculated Risk article linked to above also detail steady improvement in hotel RevPAR, or revenue per available room.

Here is chart from Calculated Risk showing a steady improvement in hotel occupancy:

The Calculated Risk article linked to above also detail steady improvement in hotel RevPAR, or revenue per available room.

Subscribe to:

Comments (Atom)